The cost of health insurance premiums may be lowered by applying for a premium tax credit. Do I Qualify for a Tax Credit for Health Insurance? The premium tax credit seems to be a refundable credit which helps decrease the cost of your quarterly health insurance premium and is only accessible to people who buy insurance via a statewide or federal health insurance marketplace. To get the credit, you must satisfy certain criteria and submit a separate form, including your tax return. You may determine whether you are qualified for the premium tax credit whenever you apply for such a health insurance plan via the marketplace. If you operate a small company with less than 25 workers, you may also be eligible for federal subsidies to help pay for your employees' health insurance.

Who Is Eligible To Receive The Tax Credit For Health Care?

Until recently, the only way to get a tax credit for medical expenses was to purchase insurance via a federal or provincial marketplace (also called an exchange) and have a low or moderate income. Around 12 million people in the United States used a public health coverage marketplace in 2021.2 However, in light of recent events in the country, this number has dropped dramatically. As of 2020, private insurance accounted for 66.5% of the insured population, according to the Census Bureau. Thanks to a new government series named "enlarged direct enrollment, "4 advertisement insurers and commercial exchanges may be capable of signing you up immediately for tax credits when purchasing health insurance. Although insurers' capabilities differ, verifying if you're thinking about these choices is a good idea.

What Is The Health Insurance Premium Tax Credit?

A component of either the Affordable Care Act is the premium tax credit. It's meant to assist eligible families and individuals in reducing the cost of health insurance premiums monthly. If you enrol in a qualified plan through the Health Insurance Marketplace, you are eligible for the credit. You may choose when to utilize these funds provided you qualify; however, you cannot use them toward a catastrophic plan. The credit only applies to "metal" plans (gold and silver) on the exchange. Everyone or part of your premium tax credit may be taken as an advance payment towards your health insurance provider each month; alternatively, you can wait until tax time to claim your premium tax credit in full and get a refund. In other words, you won't get the cash in hand.

Income Requirements

It would be best if you had a family income that is between 100% as well as 400% of the federal poverty line. To qualify for the premium tax credit, their family's yearly income must be between the two sums shown for their family size in the table above. However, the American Rescue Plan of 2021 granted a temporary boost inside the premium tax credit during 2021 and 2022. The maximum premium contribution per family must not exceed 8.5% of the household expenditure for benchmark and maybe less costly plans.

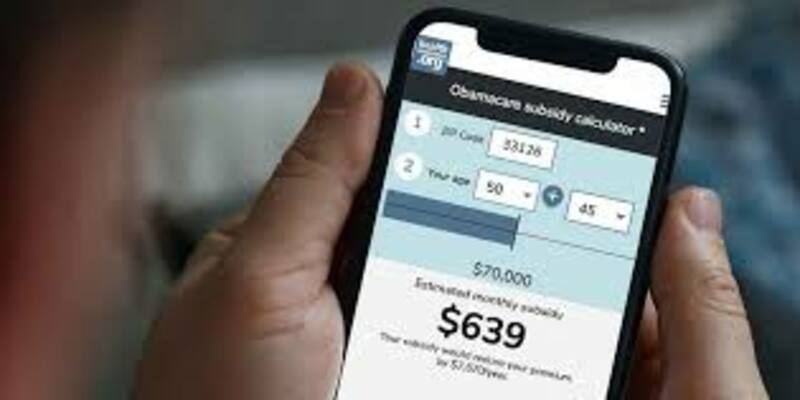

Submit An Application For Health Insurance On The Market

A premium tax incentive would only be available for plans purchased through the Marketplace. Therefore, it is necessary to submit an application for coverage. The financial information that you provide on the application is used to perform the calculations necessary to establish the amount of the insurance tax credit you are eligible to receive.

Conclusion

Premiums for medical coverage may come at a hefty cost. If you qualify, you may be able to get a discount on your premiums each month. Numerous Americans spend hundreds of dollars per year on health insurance; this doesn't include deductibles, copayments, or other expenses. Insurance premiums are termed premiums. Thus the health care tax credit is also called the premium tax credit because it helps lower the monthly cost of medical insurance for low-income individuals. Individuals and families must fulfill income and size requirements to be eligible for this program, which is only accessible to people who buy health insurance via a statewide or federal healthcare insurance marketplace.