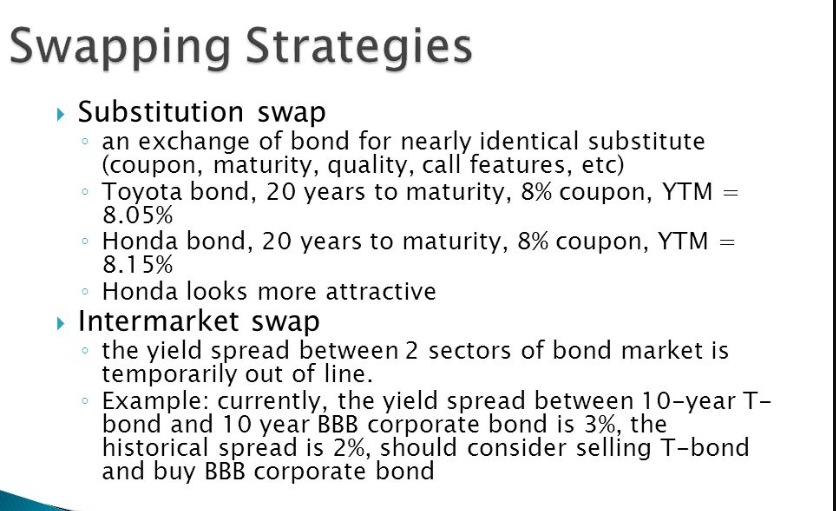

The exchange of one bond for another with comparable features but a greater yield is known as a substitution swap.

Investors utilize substitution swaps when they believe there might be a short-term gap in bond prices that market forces will shortly resolve.

Short-term trades termed a realized compound yield strategy attract substitution swaps.

Knowledge of Substitution Swaps

In essence, a substitute swap enables the investor to boost returns without changing the conditions or level of risk associated with the investment. A swap that involves the sale of one fixed-income security in exchange for higher-yielding security is known as a substitution swap. Investors engage in replacement swaps when they anticipate that a transitory gap in bond prices, or yields to maturity (YTM), would soon be resolved by market forces.

Swapping is exchanging one security for another to modify an investment's characteristics. When investing goals change, the shift may also take place. An investor might, for instance, take part in an exchange to raise the security's maturity date or credit rating. Substitution swaps are frequently used to avoid paying capital gains taxes that would be incurred in an outright sale. Exchanges, such as currency, commodities, and interest rates, can be in various forms.

Example of a Substitution Swap

Two corporate bonds with a 20-year AAA rating and a 10% coupon now priced at $1,000 and $950, respectively, could be substituted for one another. Over a year, both bonds pay out $100 in interest, but the first bond's owner has made 10% on every dollar invested, while the second bond's owner has made 10.5% on every dollar invested because they spent $50 less for their bond.

As the example demonstrates, the difference in yield between two otherwise identical bonds is frequently quite modest, possibly only a few basis points. However, the benefit can increase by a whole percentage point or more if reinvested the additional return throughout the period between the two bonds. The approach behind realized compound yield that makes substitution swaps appealing is realized compound yield. Substitution swaps are typically seen as short-term market plays, typically lasting a year or less, because market forces will eventually bring the two returns together after a time frame known as the workout period.

Risks of Substitution Swaps

Swaps of substitution are transacted on the over-the-counter (OTC) market between private parties rather than on an exchange. As a result, there is a chance of counterparty default or bond characteristics being misrepresented. Additionally, some methods include market forecasting, which is inherently dangerous. Specialised firms and institutions often carry out substitution swaps rather than ordinary investors due to these considerations, the complexity of the process, and the requirement to invest substantial sums to generate meaningful benefits over incremental yield swings.

What Happens During a Substitution Swap?

When an investor's investment intentions change, a security swap occurs. For instance, investors may swap securities to raise the security's credit quality. A substitution bond entails selling a bond instrument and using the proceeds to buy another debt instrument comparable to the one sold but with a higher chance of return. Investors primarily use substitute swaps to lower their tax obligations to strengthen their financial standing.

Benefits of a Replacement Swap

Investors are participating in a replacement swap exchange of one bond for another by selling and buying. Gaining tax advantages is the key reason for doing this. The investor can use the bond's losses to offset other tax obligations if they don't buy similar bonds sold within 30 days.

Examples of Swaps in Substitution

A substitution swap typically involves two corporate-rated bonds with comparable 10 per cent coupon rates. For instance, a bond that costs $1,000 and another that costs $950 is likely to generate an interest rate that is similar over time. An investor may choose to exchange a pricey bond for a cheaper one. Since the investor is likely to buy more bonds, reinvested excess proceeds from the sale of the pricey bond will improve the percentage of investment returns. The realized compound yield technique makes replacement swap generally appealing in the end.

The Risks of a Substitution Swap

Since they are traded over the counter, there is a greater chance that the market may interpret their expected returns incorrectly.

To make an investment that can provide significant profit margins, they need a lot of capital, which is risky.

The risks associated with substitution swaps are higher because they are typically short-term and strongly reliant on interest rate assumptions.

By utilizing a dealer firm as a subsidiary with foreign stock, which will be used to evaluate the investor's position, the investor can overcome the restriction, for instance, if a country forbids certain investors from owning a particular percentage of shares. However, because of the additional costs involved, the terms are less favourable than those previously.